Accidents and natural catastrophes are two examples of catastrophic events that happen on occasion. These unusual events can potentially harm people’s lives and property when they occur seriously. The catastrophic claims-adjusting sector enters the picture here. Their job is to help people impacted by such catastrophes quickly and effectively by delivering financial relief through different compensation options. This post will outline catastrophic incidents and discuss how the claims-adjusting sector handles them. Along with these topics, we’ll talk about the condition of the claims-adjusting market, the advantages of a thorough claims-adjusting procedure, and the value of empathy in the sector.

Overview Of Catastrophic Events

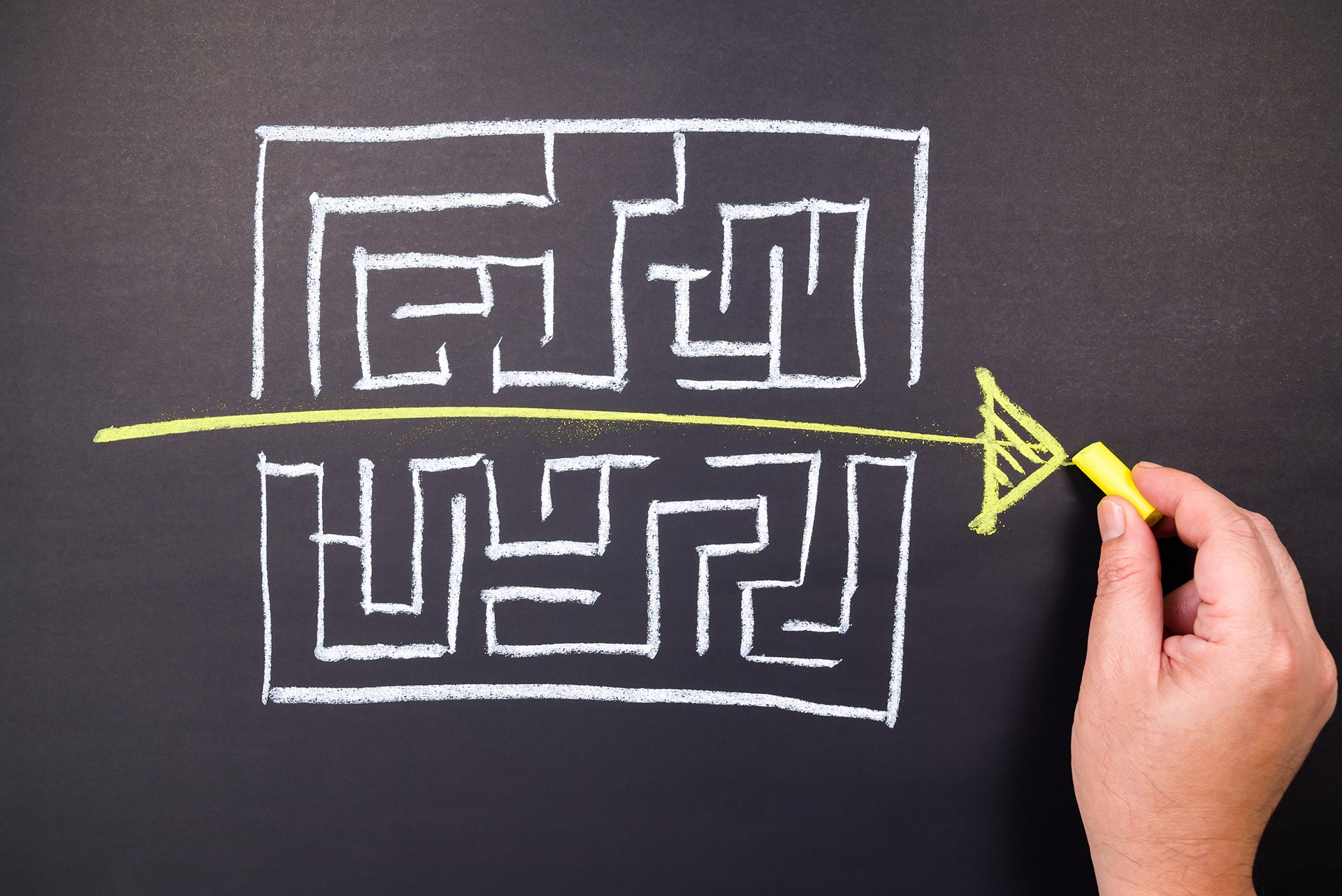

Catastrophic events are a reality in the claims-adjusting industry. From natural disasters such as floods and storms to accidents and other unforeseen losses, these types of non-routine occurrences are inevitable. Such incidents require understanding their severity and timely response from those who offer assistance. It is here where the importance of empathy in claims adjusting becomes evident.

It is no secret that catastrophic events can cause significant damage to people’s lives, businesses, property, and possessions. For this reason, it has become increasingly crucial for the claims-adjusting industry to respond quickly with compassion and expertise when dealing with such cases. A successful adjuster must possess technical knowledge regarding policies, procedures, and practical communication skills, allowing them to empathize with victims while providing accurate information. This ability to combine efficiency with empathy allows our adjusters to provide exceptional service during trying times.

How Does the Claims Adjusting Industry Respond to Catastrophic Events?

Claims adjusting is an industry that plays a vital role in responding to natural disasters and other events. It is responsible for helping people recover from their losses during such distress or disruption by providing financial relief through various compensation plans. Claims adjusters are competent professionals who assess the damage caused by these catastrophes, determine eligibility criteria for payouts and settlements, and help victims receive what they are entitled to.

The claims adjustment process requires excellent attention to detail and significant empathy toward those affected. With each passing event, claims adjusters become better at understanding the nuances of certain situations while still providing efficient service while maintaining high standards of professionalism. This combination of empathy and efficiency allows them to deliver exceptional customer service even during trying times.

State of the Claims Adjusting Industry

The claims-adjusting industry has seen rapid growth in recent years. This has been driven by the need for insurers to manage and control their costs and rising consumer demand for speedy claims resolution. Adjusters must be knowledgeable about various topics, including insurance law, contract interpretation, risk management principles, and customer service protocols. They must also have strong interpersonal skills to interact effectively with claimants and other parties involved in a claim dispute.

Technological advances have enabled claims adjusters to process claims more efficiently and provide faster outcomes for customers. Automated systems allow them to quickly access information from multiple sources and apply it appropriately during adjustment. Additionally, new technologies enable remote working capabilities so adjusters can work from anywhere with an internet connection. These tools help ensure consistent delivery of quality services while saving time and money for insurers.

Benefits Of A Thorough Claims Adjusting Process

The benefits of a thorough claims-adjusting process are numerous. A comprehensive approach ensures that claimants receive timely and accurate compensation for their losses, minimizing the financial burden caused by an accident or other incident. When adjusters take the time to investigate each claim thoroughly, they can better understand the circumstances surrounding it to make informed decisions about appropriate coverage and payments. This helps reduce potential disputes between insurers and claimants, ensuring all parties involved get what is fair.

Moreover, when adjusters use empathy during this process, they create more positive experiences for claimants by demonstrating understanding and compassion. This increases customer satisfaction with insurance providers and reinforces trust in their services, encouraging people to seek out their products in the future. Additionally, efficient claims adjusting procedures can save money since less time is spent processing paperwork or investigating cases. A thorough yet empathetic approach improves outcomes for both sides while ensuring companies remain profitable.

In summary, catastrophes are unavoidable, and the claims-adjusting sector is essential to recovery. The claims adjuster’s role is to aid victims in recovering by offering financial assistance via various compensation schemes. Natural catastrophes and other unplanned losses may seriously harm people’s lives and possessions. The claims adjustment process involves empathy, technical expertise, and excellent communication skills to deliver extraordinary service during challenging circumstances. Insurers’ need to control costs and growing customer demand for prompt claim settlement have spurred the industry’s fast expansion.

A rigorous claims-adjusting process guarantees prompt and precise reimbursement, lowers the likelihood of disputes, and boosts customer satisfaction, while effective procedures help insurers save time and money. Empathy combined with efficiency is the key to delivering exceptional customer service and reinforcing trust in insurance providers’ services, encouraging people to seek out their products in the future.

Affected by a Catastrophic Event?

If you’ve been a catastrophe victim, let us help you recover. Our experienced claims adjusters are here to offer financial assistance and help you navigate the claims process with empathy, technical expertise, and excellent communication skills. Trust BSA Claims to deliver exceptional customer service and help you get the reimbursement you deserve.

Contact us today to learn more.