The primary benefit of private claims administration is its ability to provide a more streamlined approach than traditional methods often involve. By utilizing experienced professionals specializing in this area, businesses can save time and money while ensuring accuracy and compliance with all applicable rules and regulations. In addition, private firms often offer additional services such as dispute resolution assistance or specialized software tools that help manage information quickly and accurately. The remainder of this article will discuss how companies can take advantage of these benefits by implementing effective strategies for working with PCAs.

Automated Processes for Claims Management

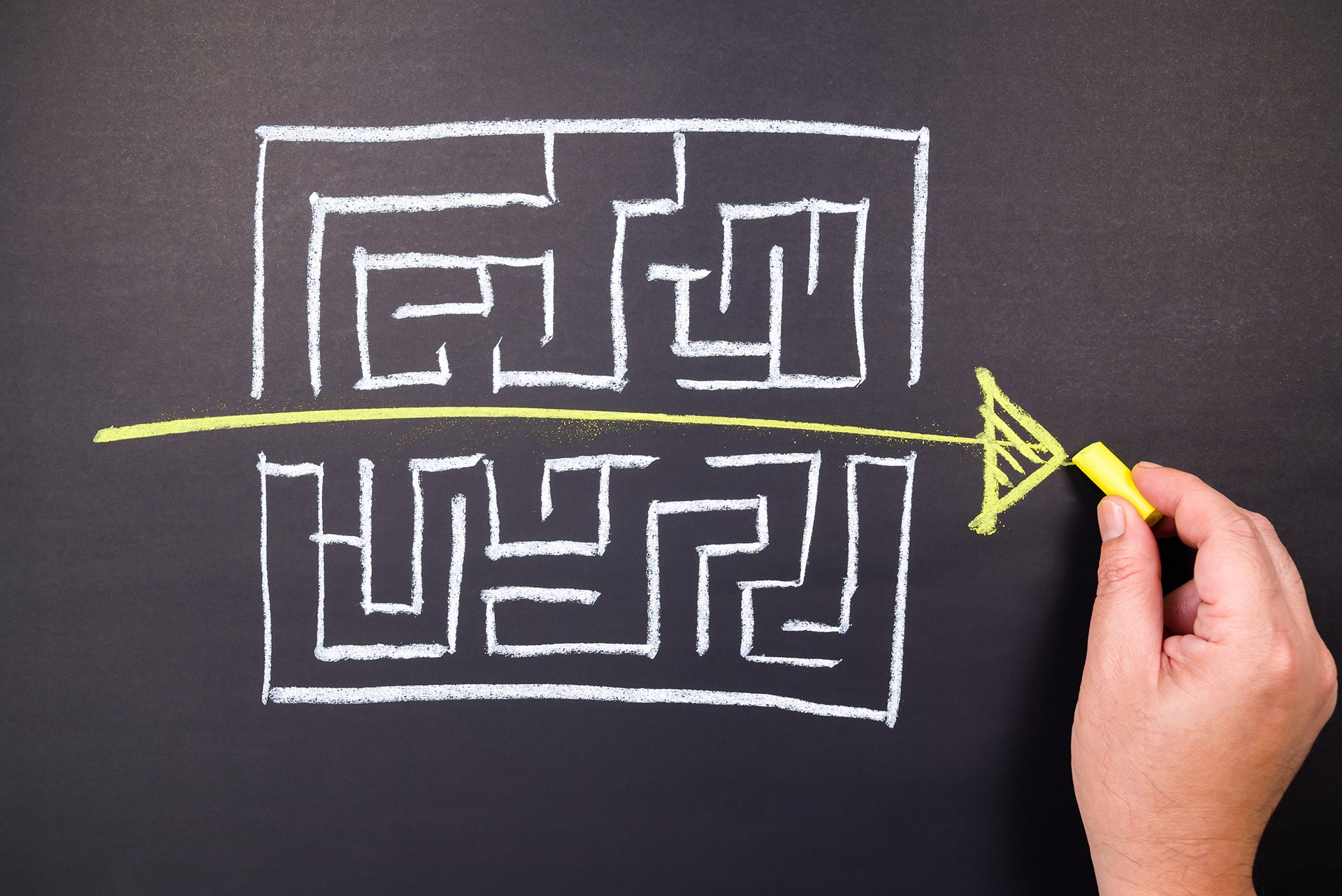

Claims management involves various activities, from processing and settling claims to managing customer inquiries. As the complexity of these tasks grows, companies are looking for more efficient ways to manage their processes. Automated processes offer an effective way to address this challenge. Organizations can automate certain aspects of their claims management process by leveraging data-driven insights while reducing paperwork and streamlining operations.

Automated systems allow companies to quickly capture valuable information about customer requests, enabling them to respond promptly and accurately. It also allows teams to better organize large volumes of claim records in a secure, easy access and analysis environment when needed. Furthermore, automation eliminates manual errors associated with traditional paper-based methods ensuring accurate recordkeeping and faster response times. With these benefits in mind, implementing automated solutions for claims management provides many strategic advantages for businesses looking to maintain a competitive advantage in today’s market.

Tracking And Monitoring Filing Progress

Effective filing progress tracking and monitoring are essential for successful private claims administration. Through specialized software, organizations can track individual claim processing stages to ensure the accuracy of the settlement process. This type of tracking allows for better team coordination while providing visibility into each claimant’s status. Additionally, it will enable administrators to quickly identify any potential issues that might arise during the settlement process.

Filing tracking also helps increase efficiency by reducing data entry time and allowing administrators to review all open files quickly and on time. Furthermore, improved reporting capabilities provide valuable insights into trends such as average cycle times or outstanding payments that help facilitate better decision-making when handling claims. As a result, companies can address errors or delays more efficiently and reduce overall costs associated with settling their cases successfully.

To maximize the benefit of these tools and techniques, companies must allocate adequate resources for training staff on properly utilizing them across different departments. Doing so will enable staff members to become proficient in using the system for effective tracking and monitoring of filing progress, which leads to increased claims settlement accuracy and reduced operational costs over time.

Improved Settlement Accuracy of Claims

The successful tracking and monitoring of filing progress enable companies to leverage the benefits of private claims administration for improved settlement accuracy. Private claims administrators are equipped with specialized knowledge, resources, and technology that will allow them to interpret insurance policies, calculate damages accurately, and process claims settlements efficiently. As a result, organizations benefit from increased efficiency in their administrative operations while reducing labor-intensive manual claims processing costs. With an emphasis on team coordination between the organization’s internal staff and external third-party administrator, it is possible to ensure accurate data entry into the system and timely resolution of current and future claims.

To maximize cost-effectiveness within the private claims administration space, organizations can implement strategies such as automating routine tasks or outsourcing certain components to experienced third parties specializing in specific areas like fraud detection or medical records management. Additionally, by leveraging analytics tools or artificial intelligence techniques such as machine learning algorithms, organizations can reduce the time spent manually reviewing large volumes of documents related to each claim. Organizations should also take advantage of digital solutions that streamline communications between multiple stakeholders involved in resolving a single claim – this helps maintain clarity throughout the entire process and reduces potential errors due to miscommunication or incomplete information.

Streamlining Communication Channels

Streamlining communication channels is essential to making private claims administration more manageable and efficient. With the right strategies, reducing paperwork by automating processes and allowing for smoother information exchange between parties is possible. Utilizing technology like cloud computing, text messaging, emailing, and other digital platforms, all stakeholders can quickly access pertinent data without physically sending documents back and forth. This allows for a faster resolution process and reduced costs associated with mailing and handling physical forms. In addition, implementing a system that integrates document management software into existing systems can help simplify workflow procedures and improve organization within the private claims administration structure.

Furthermore, this approach not only simplifies the overall process but helps eliminate potential errors that may arise from manual inputting or incorrect filing of paper documentation. These technological advances provide many advantages when managing private claims, such as improved accuracy and efficiency. As such, organizations should consider investing in solutions that leverage emerging technologies to reap maximum benefit from their private claims administration efforts.

Cost-Effective Resolution Solutions

Building on the communication channels discussed in the previous section, private claims administration offers cost-effective resolution solutions that make your claims management process easier and more efficient. Private claims administrators can provide a comprehensive suite of services to help you reduce costs while providing quality service.

The first step is identifying potential savings opportunities within your existing claim processes. By doing so, you will be able to identify areas where improvement or streamlining may be necessary quickly. This could include outsourcing specific tasks, such as investigating new claims or verifying payment information, freeing up resources for other activities. Additionally, utilizing advanced software systems allows you to streamline data collection and review from multiple sources into one centralized location for easy access.

In addition to reducing operational costs, several strategies for maximizing success with private claims administration exist. Developing clear procedures for submitting and processing claims allows quicker turnaround times and helps ensure payment accuracy. Establishing solid relationships with key stakeholders involved in the process also helps create an environment of mutual trust and understanding between all parties. Finally, investing in ongoing training programs ensures staff remains current on industry standards and best practices when managing claims.

Team Coordination for Maximum Efficiency

Team coordination is essential for successful private claims administration. When all team members work together effectively, efficiency and accuracy can significantly improve. The first step in achieving optimal team performance is to ensure each member understands their role and responsibilities. This includes specifying roles and tasks, setting expectations, developing protocols, providing appropriate tools and resources, and establishing communication mechanisms such as frequent check-ins or regular meetings.

The next step involves ensuring adequate processes are in place to monitor progress toward desired outcomes. This may include tracking data points or project milestones, regularly evaluating performance goals or objectives, and implementing feedback loops to identify areas for further improvement. Additionally, it is vital to foster an environment of collaboration by encouraging open discussion among team members so they can share ideas and best practices while holding each other accountable for meeting deadlines and delivering results.

Data-Driven Insights for Optimal Performance

To ensure maximum efficiency, effective claims management requires data-driven insights. By leveraging the power of technology to analyze and interpret large sets of complex data, organizations can identify trends, uncover opportunities for improvement, and clearly understand their current performance about industry benchmarks. Private Claims Administration (PCA) offers various services that enable companies to gather and use this vital information for informed decision-making.

The following are just some of the benefits that PCA provides when appropriately used:

Increased Efficiency

PCA helps to streamline operations by providing insight into areas where processes may be improved or automated. This allows businesses to reduce manual labor costs while still ensuring quality outcomes.

Improved Quality Assurance

Data analysis enables more accurate tracking and monitoring of claims activities so that any changes or deficiencies are immediately identified and corrected before they become significant issues.

Greater Visibility

With access to detailed reports on claim activity and performance metrics, organizations have better visibility into what is happening within their system.

PCA has proven invaluable in helping many businesses succeed with their claims management efforts. However, specific strategies should be implemented to maximize its value, such as selecting a reputable service provider who understands your organization’s needs and the evolving technologies available. Additionally, taking steps towards developing key performance indicators (KPIs), setting measurable goals, utilizing analytics tools for reporting purposes, and establishing feedback loops will help increase transparency throughout the process. Through these measures, managers can accurately track progress over time, allowing them to evaluate results against set criteria quickly and effectively.

Increased Visibility and Centralized Control

Private claims administration can give an organization increased visibility and centralized control of its claims management process. This offers several benefits, including:

- Reduced costs due to streamlined processes like automated notifications and document storage.

- Improved accuracy by reducing administrative errors and manual processing steps.

- Greater security because all data is stored in one secure location rather than distributed across multiple systems or databases.

Also, private claims administration allows organizations to customize the process to meet their specific needs and requirements. This includes configurable workflows, customizable reporting tools, and access to real-time analytics, allowing for better decision-making regarding claim resolution strategies. Furthermore, this type of solution also allows for easier integration with existing systems – allowing for seamless communication between departments or teams involved in the claims management process.

Organizations looking to make their claims management more efficient should consider implementing a private claims administration system which will enable them to gain greater visibility into their operations while providing centralized control over the entire process from end to end. Benefits include:

- A decrease in operational costs associated with managing claims

- Increased accuracy resulting from fewer manual tasks and reduced potential for error

- Enhanced security through single-source data storage

- Customizable configuration options tailored to each organization’s unique needs

- Easier integration with other systems enabling improved communication among stakeholders * Increased scalability to handle increased workloads and accommodate growth.

BSA Claims Solutions offers many advantages to those looking to make their claims management more accessible and efficient. Its quick setup, low-cost investment, and guaranteed accurate settlements via data-driven methodologies have made it a popular choice for organizations who want to revolutionize their operations.